Contact your local

Oliver James office

North America

Your talent partner across a fast-growing and diverse market

With over a decade of on-the-ground experience, we’ve built a rapidly expanding presence across the US and Bermuda. From major financial hubs to high-growth regional markets, our reach enables us to deliver agile, tailored talent solutions across a wide range of industries and business functions. As a trusted partner in this competitive and dynamic landscape, we help clients secure top-tier talent that drives long-term success.

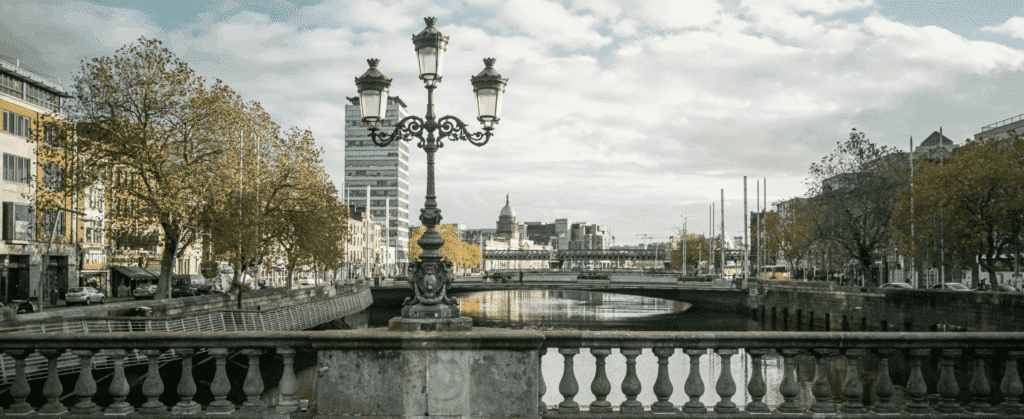

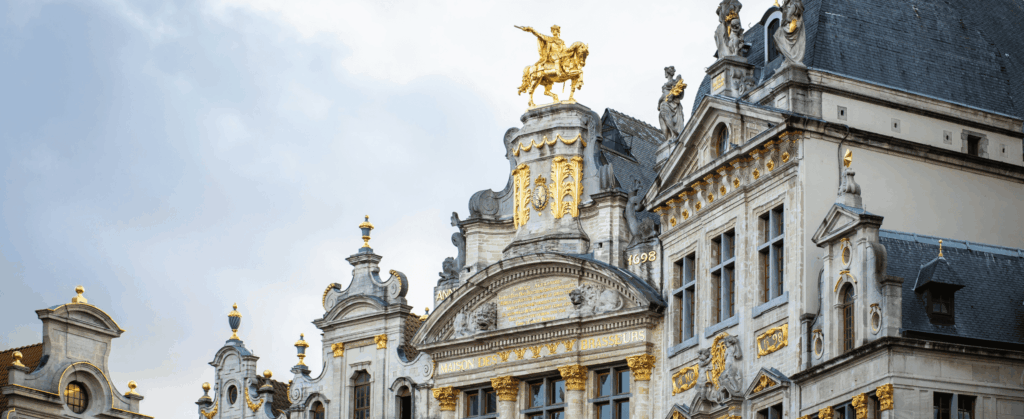

Europe

Cross-border capability with local expertise

Founded in the UK in 2002, our strong European footprint enables us to deliver consistent, high-quality talent solutions across multiple countries and sectors, including Financial Services, Commerce and Industry, and Professional Services. Clients rely on our local expertise and seamless cross-border delivery to navigate complex hiring landscapes, meet evolving workforce demands, and drive business performance across the region.

Asia-Pacific

Regional depth with global reach

As our first international location, Asia-Pacific remains a strategic hub. With a well-established presence in markets such as Hong Kong, Singapore, and Malaysia, we specialise in supporting clients across Financial Services, Insurance, and other fast-evolving industries. Our regional insight, combined with global delivery capability, enables us to connect businesses with the specialist talent they need to lead through transformation and maintain a competitive edge.